CLARIFICATIONS SOUGHT BY CHAIRMAN & MEMBERS OF 7TH CPC

DURING ORAL EVIDENCE & PRESENTATION BY IRTSA ON 12-12-2014 AT

JODHPUR

Inter-action by the Chairman,

Secretary & the Members of 7th CPC with IRTSA and clarification

placed by IRTSA delegates during the Presentation.

1. Ques. (by Chairman 7th CPC)

You said that Senior Technicians are taking instructions from JEs;

while the Chief OS (Office Superintendent) took instructions from SSE

and you also told that it is Office of Senior Section Engineer which

controls all activities and all of them working within that – It appears

that there is clear command line available, How it interferes in your

Grade Pay?

Ans. i. Principle

recommended by 6th CPC, which was also accepted by Govt, that, the

senior post should be given Higher Grade Pay need to be followed duly

considering duties, responsibilities, accountabilities, etc. but the

same is being violated by placing the JEs in the same Grade Pay of

Rs.4200 as that of Senior Technician whom they supervise and by placing

SSE (Senior Section Engineers) in same Grade Pay of Rs.4600 as that of

Chief OS whom the SSE supervise. This is against the settled law that an

equal cannot be over an equal.

ii. 5th CPC recommendations & Supreme Court Judgement supports this argument.

iii.

Take an example: A senior technician welder working in Bogie Frame

manufacturing section is responsible to the extent of welding done by

him, where as a Technical Supervisor is responsible for the quality

& quantity of output of not only of that welder but for entire

section which may contain 20 to 30 Technicians besides others.

iv.

More than that man, material, machine, other infrastructure etc, are

controlled by Technical Supervisors, which possess higher responsibility

& accountability than other posts.

v. Similar is the case of certification of train, P.Way, Bridge, Power Distribution, Locos, etc.

vi.

Categories like Ch.OS don’t have direct responsibility on performance

& safety of Railways, whereas JE/SSE and their counterparts (CMT,

Store) in all Technical Depts. bear direct responsibility in core

activities of Railways.

2. Ques. Is all 4 tier of Technicians work under your category in all areas?

Ans. Yes.

In all areas 4 tier of Technicians, along with one Group ‘D’ category

besides clerk, material / stores clerk, OS, Ch.OS work under our

category.

3. Ques. Who writes ACRs for Ch.OS who are working in office of SSE?

Ans. Respective AMWs/AEs/AEEs etc.

4. Ques. Why can’t SSE write ACRs for Ch.OS who are working in their office?

Ans. SSEs who are in the same GP of Rs.4600 cannot write the ACRs for Ch.OS.

5. Ques. Who writes ACRs of Senior Technicians who work under JEs?

Ans. Senior Technicians’ ACR are written by SSEs

6. Ques. What would be the reason for non application of common multiplication factor of 3.25 to SSE (S-13) scale by 5th CPC?

Ans. i. 5th CPC had applied common multiplication factor of 3.25 to all scales except to SSE (S-13) scale.

ii. This had been done merely to accommodate a new scale in Gazd scale (Rs.7500-12000) above S-13.

iii. SSE scale had been kept Rs.50 below than Rs.7500, ie.Rs.7450.

7. Ques. How the disadvantage of non-application 3.25 multiplication factor carried through to 6th CPC?

Ans. i. Initially 5th CPC recommended Rs.7000-11500 to SSE compressing it to accommodate the newly introduced Gazetted scale.

ii.

If 3.25 multiplication factor had been followed by 5th CPC, the scale

would have been placed in 8000-12000 by the 5th CPC and correspondingly

Rs.5400 GP in 6th CPC.

iii. After the

implementation of 5th CPC recommendations, based on demand from staff

side when Govt. decided to modify the scale of SSE (S-13) instead of

placing it in scale 8000-12000, it had been decided to modify minimum of

the scale from Rs.7000 to Rs.7450 to keep it below newly created scale

of Rs.7500-12000.

iv. Since corresponding

increase of Rs.450 had not been done for maximum of scale, Span of the

scale has been reduced to 18 years which was 20 years for all other

scales.

v. The principle of 6th CPC to

calculate the Grade Pay as 40% of maximum of the fifth pay commission

scales put SSE scale in further disadvantageous position since maximum

of scale was low because of 18 years span & non application of 3.25

multiplication factor.

8. Ques. You said that there were proposals sent to Finance Ministry from Railway Ministry to upgrade the Grade Pay of SSE from Rs.4600 to Rs.4800 and that have been returned back without throwing proper light into it, can you produce copy of the proposals?

The

proposals and communications between both the Ministries were very well

available with Railway Board. (Later Secretary Pay Commission confirmed

availability of Railway Board proposals sent to Fin. Ministry) (Copy of

it is also attached herewith as Annexure – 14/2)

9. Ques. Is there any link available between the cadre of Group ‘C’ and ‘B’?

Ans.

No. Promotional avenue from Technical Supervisors in Group ‘C’ to Group

‘B’ is restricted to the vacancies arising from 4200 Group ‘B’ posts,

which may be around 0.5% only.

10. Ques. As you said, Previous Pay Commissions recommended Group ‘B’ status to your scale DoPT also given their orders, it is only Railway Ministry not followed the classification, is it not Railways to take decision?

Ans. i. It is true that Railways have not implemented the classification of posts recommended by Pay Commissions & DoPT orders.

ii.

We bring to your notice, submission made by DoPT before 5th CPC that

even though there were some exemptions in following the classification

rules, but the effort was to ensure that posts carrying similar

functions were given the same classification.

iii.

Similarly placed posts in departments like CPWD, Ordinance Factory,

MES, Department of Telecom etc, are all classified as Group ‘B’

Gazetted.

v. State Governments which are

following central pay commission pattern have also followed DoPT orders

in classification of posts.

v. Railway Board

also agreed on the need to increase the managerial posts (from the

senior supervisor) on functional justification, but didn’t implement.

vi.

Hon’ble 7th CPC is requested to give specific instruction for Railways

not to deviate from classification rules recommended for all Government

Departments.

11. Ques. What are all the reasons for lack of promotion to your category?

Ans.

i. Recruitment happens in the apex scale of Group ‘C’ in the Grade Pay

of Rs.4600 with Graduate in Engineering qualification and Railways is

the only dept which recruit Engineering Graduates in Group ‘C’.

ii. Available Group ‘B’ posts are very meagre to the extent of 4200.

iii.

For example in Mechanical department of Integral Coach Factory

sanctioned cadre strength of Group ‘B’ is only 16. Cadre strength of

Technical Supervisors in Mechanical Department (JE & SSE) is 1200.

There are roughly 60 Engineering Graduate entrants available many of

them completed 20 years of service. There is not enough opportunity

available because of meagre Group ‘B’.

iv. Confining Cadre Restructure within each Group C, B & A was the main cause of stagnation in Group C.

v. Combined cadre structure for Group ‘A’, ‘B’ & ‘C’ is not available in Railways.

vi. Apex scale of SSE never received the benefit of Cadre Restructuring.

vii.

Upgradation from Group ‘D’ to Group ‘C’ and from Group ‘B’ to Group ‘A’

is being done in Railways, but no upgradation done from Group ‘C’ to

Group ‘B’.

viii. Ratio of Group A& B

Gazetted officers vis-à-vis Group C are the lowest on the Railways as

compared to all other Departments.

ix. During

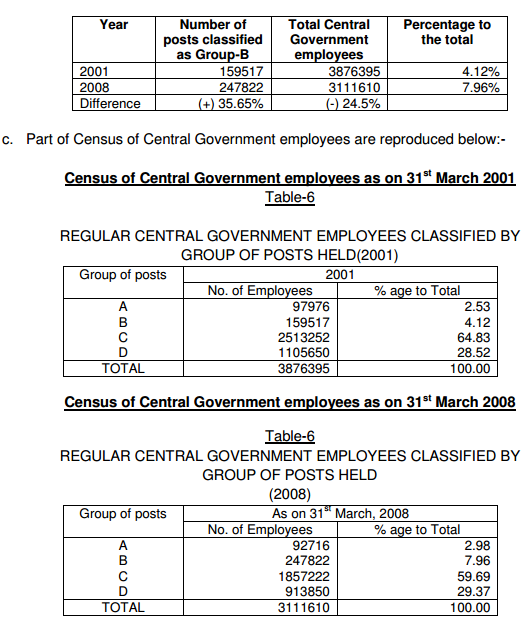

previous 8 years number of Group-B employees in Central Govt Departments

have increased by 36% even though employee strength reduced by 25%, But

Railways never increased Group ‘B’ posts.

x.

Gazetted posts were not increased in tune with increase of Railways

performance including financial performance. Railways outlay was

increased from Rs.60,600 crores during 10th plan to Rs.5.5 lakh crore

during 12th plan Railways. Many of increased activities / work load are

being managed by outsourcing, since there is negative growth in staff

strength.

Source: http://www.irtsa.net/pdfdocs/Supplementary_Memorandum_to_7th_CPC.pdf