PSU bank employees will soon get pay hike, arrears for 30 months

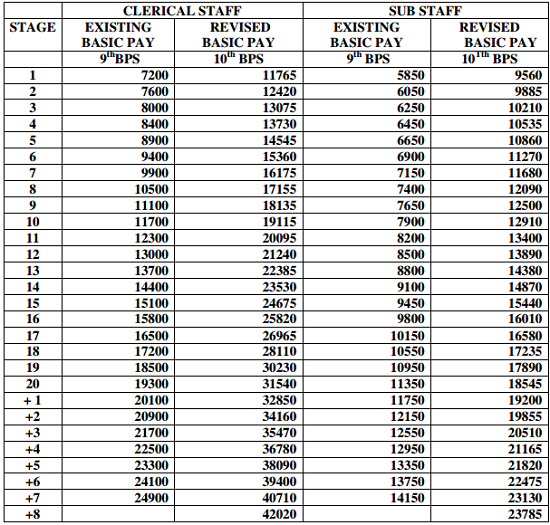

Mumbai, May 22: Employees of public sector banks, old generation private sector banks and some foreign banks will be a happy lot as they will soon get 15 per cent pay hike, arrears for the last 30 months, and other benefits as part of a deal that the unions and bank managements have reached.

Unions, under the aegis of the United Forum of Bank Unions, and bank managements, represented by the Indian Banks’ Association, have worked out a detailed Bipartite Settlement/ Joint Note and the same will be formalised on May 25.

The benefits that about 7.50 lakh bank employees stand to get are a special pay, a new hospitalisation scheme backed up by insurance and holiday on every second and fourth Saturday in a month.

The back wages (arrears) that bank employees will get for the last 30 months will warm the cockles of their heart. Income tax authorities too will be happy as arrears will be taxable.

S Nagarajan, General Secretary, All India Bank Officers’ Association, said “A special allowance has been introduced for employees… there is a new hospitalisation scheme backed up by insurance.” The wage settlement will benefit 3,04,000 odd officers (as on March 31, 2012) in the banking sector.

Officers will get health insurance cover of Rs. 4 lakh and the clerical and sub-staff will get Rs. 3 lakh cover, he added.

A corporate buffer will be created by banks to reimburse hospitalisation expenditure exceeding the above mentioned limits.

Pointing out that the last wage settlement expired in October 2012, Nagarajan, in a lighter vein, observed that “Five years is the tenure of the wage settlement. We have already exhausted 30 months in coming to a settlement. It’s time now to submit the next charter of demands.”

Vishwas Utagi, Vice President, All India Bank Employees Association, said the wage settlement will benefit about 4.50 lakh clerical and sub-staff in the banking sector.

Bank employees will get close a couple of lakh rupees, on an average, as arrears in gross terms, he explained. Since payrolls are computerised, the arrears could be credited to employees’ accounts in a month.

Utagi said the issue of upgradation of pension of retirees and 100 per cent neutralisation of dearness allowance will be taken up by the United Forum of Bank Unions separately.

Read at: The Hindu Businessline

Mumbai, May 22: Employees of public sector banks, old generation private sector banks and some foreign banks will be a happy lot as they will soon get 15 per cent pay hike, arrears for the last 30 months, and other benefits as part of a deal that the unions and bank managements have reached.

Unions, under the aegis of the United Forum of Bank Unions, and bank managements, represented by the Indian Banks’ Association, have worked out a detailed Bipartite Settlement/ Joint Note and the same will be formalised on May 25.

The benefits that about 7.50 lakh bank employees stand to get are a special pay, a new hospitalisation scheme backed up by insurance and holiday on every second and fourth Saturday in a month.

The back wages (arrears) that bank employees will get for the last 30 months will warm the cockles of their heart. Income tax authorities too will be happy as arrears will be taxable.

S Nagarajan, General Secretary, All India Bank Officers’ Association, said “A special allowance has been introduced for employees… there is a new hospitalisation scheme backed up by insurance.” The wage settlement will benefit 3,04,000 odd officers (as on March 31, 2012) in the banking sector.

Officers will get health insurance cover of Rs. 4 lakh and the clerical and sub-staff will get Rs. 3 lakh cover, he added.

A corporate buffer will be created by banks to reimburse hospitalisation expenditure exceeding the above mentioned limits.

Pointing out that the last wage settlement expired in October 2012, Nagarajan, in a lighter vein, observed that “Five years is the tenure of the wage settlement. We have already exhausted 30 months in coming to a settlement. It’s time now to submit the next charter of demands.”

Vishwas Utagi, Vice President, All India Bank Employees Association, said the wage settlement will benefit about 4.50 lakh clerical and sub-staff in the banking sector.

Bank employees will get close a couple of lakh rupees, on an average, as arrears in gross terms, he explained. Since payrolls are computerised, the arrears could be credited to employees’ accounts in a month.

Utagi said the issue of upgradation of pension of retirees and 100 per cent neutralisation of dearness allowance will be taken up by the United Forum of Bank Unions separately.

Read at: The Hindu Businessline